Risk and Uncertainty

We live in an uncertain world and to survive a company needs to profit despite the risks and uncertainty that they operate in.

In theory financial and economic appraisal strives for:-

|

·

|

Perfect information -

|

|

·

|

Perfect foresight -

|

Clearly the real world is not like this - sources of information are not perfect, and the unexpected sometimes (often) happens.

Therefore analysing and understanding the consequences of the unexpected is as important as analysing the expected cash flow. The key factor is robustness - a good project is one that continues to be viable even under the worst of circumstances.

Various attempts have been made in the past to rigorously define the terms risk and uncertainty, and to distinguish between them. The difference is usually expressed in terms of whether it is possible to quantify the inexactness with which future values of a particular quantity are known.

So risk is where quantification can be made, if A happens the results are B so by taking action C, B it is less likely to occur and if it does its impact is lessened. For more information and help on risk processes and management go to Members.

Uncertainty is about everything else could go wrong. There are a number of processes they can be made used to work with uncertainty (see The Solution Organisation paper "Working in an Uncertain World") and a methodology called OGSM will assist. For more information on OGSMs go to OGSM and What it Means to You.

Types of Risk

There are many different risks related to an investment decision, but most can be classified into the following categories:

Economic risk

Related to the project's future operation. These can be changes in the relevant prices for inputs and outputs or developments in relevant markets.

Related to the project's future operation. These can be changes in the relevant prices for inputs and outputs or developments in relevant markets.

Company and Sectoral risk

R elated to the future performance of the firm or economic sector where the project will be realised.

R elated to the future performance of the firm or economic sector where the project will be realised.

Construction and Pre-completion risk.

Projects might encounter pre-completion risks due to technical problems in the planning or construction phase or with a new technology or due to problems in financing the investments.

Technology risk.

A new technology or new equipment might not achieve the estimated capacity or efficiency, due to unforeseen operational problems.

A new technology or new equipment might not achieve the estimated capacity or efficiency, due to unforeseen operational problems.

Input-supply risk

Certain necessary inputs for the operation of the asset might not be available in the future. This might include the spare parts necessary for continued efficient operation.

Approvals, Regulatory and Environmental risk. Very often the necessary permits cannot be obtained in time, or relevant regulations might change during the operation of the asset.

Start-up and sales risk

This type of risk is often encountered in industrial investment projects, where the envisaged sales figures may not be achieved and capacity utilisation of new production plant remains at a low level.

The Impact of the Unexpected

So what does this mean to our project and how does it affect the selection of Discount Rate and NPV?

To begin, lets consider some of the consequences of unexpected events on the cash flow of a project and to get a feel for the impact these events have on the NPV.

To illustrate the discussion, a hypothetical power project will be used. The capital cost of the project is £1,150 million spread over three years, the operating costs of the power station are £60 million per year, the expected revenues from electricity sales are £280 million per year and the project lifetime is 20 years.

The project cash flow is illustrated in the table below, with the NPV being calculated at a discount rate of 12%.

Year

Cost (Millions)

Revenue (Millions)

Cash Flow (Millions)

1

300

0

-300

2

500

0

-500

3

350

0

-300

4

60

280

220

5

60

280

220

6-23

60

280

220

NPV (at 12%)

266

The following tables now illustrate the impacts on NPV of changes to each of four key variables: construction cost; construction time; sales revenues; project lifetime.

The effect of cost escalation during construction:

This table shows that, all else being equal, a 10% escalation of costs during construction reduces the NPV of the project from £266 million down to £170 million, a reduction of over one-third.

This table shows that, all else being equal, a 10% escalation of costs during construction reduces the NPV of the project from £266 million down to £170 million, a reduction of over one-

Year

Cost (Millions)

Revenue (Millions)

Cash Flow (Millions)

1

300

0

-300

2

500

0

-500

3

350

0

-300

4

60

280

220

5

60

280

220

6-23

60

280

220

NPV (at 12%)

266

The effect of construction delay:

A delay of one year in constructing the plant is illustrated in this table. This is not entirely realistic because, in practice, a construction delay would usually also involve some cost escalation, and the construction cost would be expected to be spread out over the longer construction time. The effect of a one-year delay in construction is to reduce the NPV by nearly half.

A delay of one year in constructing the plant is illustrated in this table. This is not entirely realistic because, in practice, a construction delay would usually also involve some cost escalation, and the construction cost would be expected to be spread out over the longer construction time. The effect of a one-

Year

Cost (Millions)

Revenue (Millions)

Cash Flow (Millions)

1

300

0

-300

2

500

0

-500

3

350

0

-300

4

60

280

220

5

60

280

220

6-23

60

280

220

NPV (at 12%)

266

The effect of lower than expected sales revenues:

This table illustrates the effect of a 10% reduction in sales revenues. This may result either from reduced demand for electricity of from lower than expected tariffs. The effect is to reduce the NPV by well over half.

This table illustrates the effect of a 10% reduction in sales revenues. This may result either from reduced demand for electricity of from lower than expected tariffs. The effect is to reduce the NPV by well over half.

Year

Cost (Millions)

Revenue (Millions)

Cash Flow (Millions)

1

300

0

-300

2

500

0

-500

3

350

0

-300

4

60

280

220

5

60

280

220

6-23

60

280

220

NPV (at 12%)

266

The effect of shorter than expected project lifetime:

This table illustrates the effect of a one year reduction in the lifetime of the project. The NPV is reduced to £249 million, a reduction of about 6%.

This table illustrates the effect of a one year reduction in the lifetime of the project. The NPV is reduced to £249 million, a reduction of about 6%.

Year

Cost (Millions)

Revenue (Millions)

Cash Flow (Millions)

1

300

0

-300

2

500

0

-500

3

350

0

-300

4

60

280

220

5

60

280

220

6-23

60

280

220

NPV (at 12%)

266

These examples illustrate the huge impact which relatively modest changes in some variables can have on the NPV of a project, particularly when these changes occur near the beginning of the project.

It is therefore vitally important when appraising an investment to take into account the risk of things not turning out as expected.

However, it should also be observed that, in every case above, the NPV remains well above zero. The project has therefore proved itself to be robust against a wide range of adverse circumstances.

Do We Use Contingency or Change Discount Rate?

It is common to reflect cost-risks by applying a safety margin or contingency to the cost components of the appraisal. An appraisal which incorporates a contingency takes a cautious view of the future and rightly so. This view is likely to be the one taken by financial institutions being approached to finance a project. They are concerned only that they are not exposing themselves to undue levels of risk and so need assuring that the project will show adequate returns even under adverse circumstances.

The first of these four examples is effectively an appraisal with a 10% contingency applied to the construction cost. The results illustrate that, although the NPV is severely affected by the contingency, the project is sufficiently robust to remain profitable.

The other examples are 10% contingencies applied to the other variables.

However, they illustrate the effect of changing one key variable while keeping the others constant. In practice, a project analyst may be interested in identifying which parameters are the most critical and experimenting with a wide range of different values - this exercise is called a sensitivity analysis. It is important that the range of values chosen for the key parameters should represent realistic possible futures not just + or – 10%.

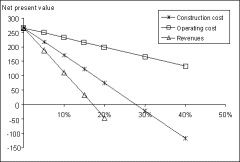

The results of a sensitivity analysis are often more easily understood if they are displayed graphically. The figure below shows the effect of varying three parameters through a range of values. A change (fall) in sales revenues of about 18% is sufficient to reduce the NPV below zero. The project is more robust against changes in construction cost, which need to increase by about 28% before the project has a zero NPV. Operating costs have very little impact on the project - the project is still viable even with a 40% escalation in operating costs.

The results of a sensitivity analysis are often more easily understood if they are displayed graphically. The figure below shows the effect of varying three parameters through a range of values. A change (fall) in sales revenues of about 18% is sufficient to reduce the NPV below zero. The project is more robust against changes in construction cost, which need to increase by about 28% before the project has a zero NPV. Operating costs have very little impact on the project -

In this example it is clear that the outcome of the appraisal is most sensitive to assumptions about likely sales revenues. This is not surprising as they are applied for a longer period than the construction cost. This should lead the project sponsors to consider ways in which they can safeguard sales.

Conversely, there is less need to worry about protecting against increases in operating costs but they are still an important element and should not be ignored.

It is possible to calculate a new NPV for every combination of different values for several key parameters. However, there are two main reasons why this is not a good idea.

|

·

|

the sheer volume of calculations required escalates very rapidly -

|

|

·

|

some permutations of alternative values may be unrealistic, because the various project parameters are not entirely independent of each other. For example, it is unlikely that there could be a construction delay without the construction cost also increasing.

|

A more efficient and useful approach to analysing risk is therefore to construct scenarios that represent feasible combinations of future values for key variables. A scenario should be a self-consistent picture of a possible future; it is not a forecast, but a "what if" exercise which gives some idea of the size of the risks involved.

Usually, only three or four different scenarios will need to be investigated in order to get a reasonable picture of the robustness of the project against adverse circumstances.

However, we rather than consider the changes to the individual variables the strength of the project can be assessed by varying the risk components of the Discount rate used.

The risk element in the Discount Rate should be assessed to realistically reflect all the risk categories mentioned in Risk in Discount Rate Selection and it may be necessary to bring specialist help to assist with Risk Identification and Mitigation and its affect on the Discount Rate.

In this example using a rate differential matrix Discount Rates between 11% and 15% would cover most contingencies and all will return a positive NPV indicating that the project should proceed.

A note of caution that changing the Discount Rate will not affect the IRR, see Internal Rate of Return, only the amount of the NPV.

Finally we can not remove all Risk or Uncertainty as we live in an uncertain world but working and managing uncertainty correctly will ensure we survive and profit.