Introduction

Whole Life Cost (WLC), Net Present Value (NPV), IRR, Discount Rate and Risk and Uncertainty are all intrinsically linked and combine to make a very powerful financial assessment process.

They are an attempt, and a good attempt, to improve the chances of getting asset selection right.

This method of financial appraisal is applicable to any proposal whether it is a construction project, the purchase of a single asset or something less tangible such as purchase of new business or even and management project.

My work over the last two years with the WLCF has led to a need to demystify the process and dispel some of the mystery surrounding financial appraisal.

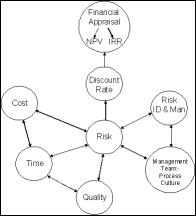

The significant fact is that financial appraisal is not a separate function from everything else in project development. Financial appraisal is the result of the management of the project and its approach to and assessment of risk. The relationships are shown in this graphic.

Just as capital and revenue costs are intrinsically linked so are all the variables in the financial assessment process. Concentrate on one to the detriment of the others and you are likely to fail.

How many companies combine finance with management, procurement, operations, and facilities management?

The project champions tend to be in operations and see finance as a blocking hurdle and facilities management that is a hindrance at best or irrelevant at worse.

Consider a common scenario, a project appraisal is built up after a need has been identified, costs are identified and incomes assessed then a financial appraisal is completed. The NPV and/or the IRR falls short of requirements, what happens next?

The project team tries to cut costs or the income projections are restated - the common question in this scenario is how much do we need to cut costs to achieve the required NPV or IRR? When this happens how many companies revise the risk appraisal with the new project Proposal and change the discount rate used in the NPV calculation?

Is it because the development team do not understand the principles of the appraisal or are their objectives different and at odds to those of the company as a whole? It often seems that the objectives of the development or construction team is to build a solution without reference to the benefit for the company.

The content of the WLCF website provides a centre of information that encourages and facilitates this combining of functions to work together. It demystifies the terms and provides easy to read descriptions of what the terms are, what they mean and what you have to consider.